All Categories

Featured

Table of Contents

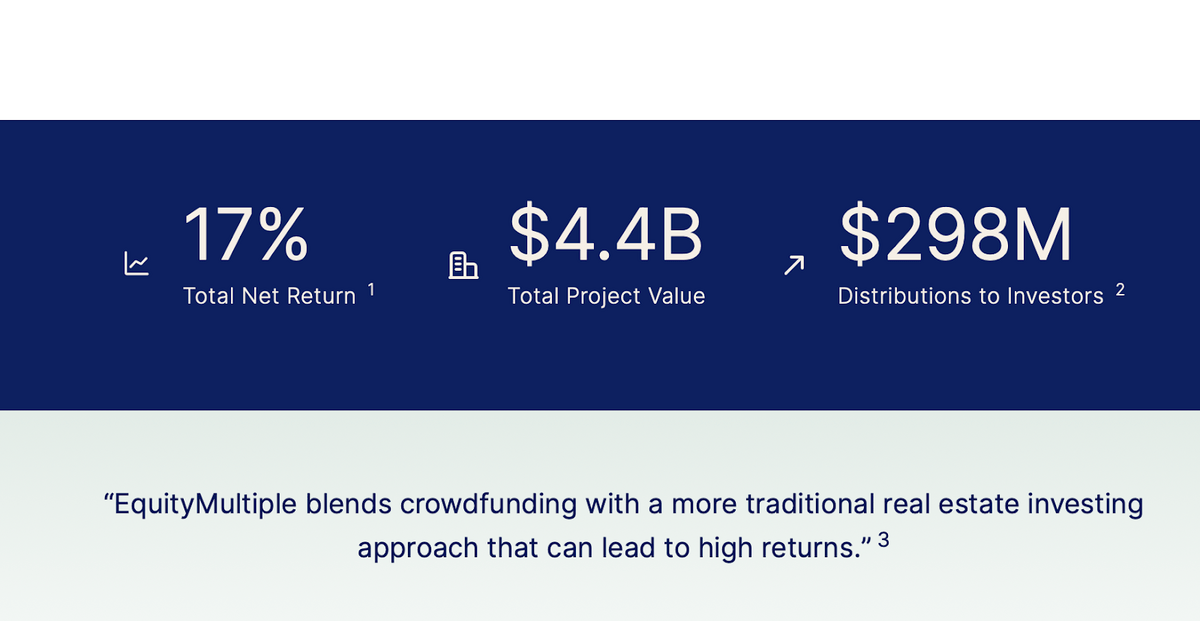

The remainder of their business real estate offers are for recognized financiers only. VNQ by Lead is one of the biggest and well understood REITs.

Their number one holding is the Vanguard Real Estate II Index Fund, which is itself a mutual fund that holds a variety of REITs. There are various other REITs like O and OHI which I am a long-time shareholder of.

To be an certified financier, you have to have $200,000 in annual income ($300,000 for joint financiers) for the last 2 years with the expectation that you'll earn the very same or extra this year. You can also be considered an approved investor if you have a total assets over $1,000,000, independently or collectively, omitting their primary house.

Why are Accredited Investor Real Estate Partnerships opportunities important?

These bargains are usually called personal placements and they don't require to sign up with the SEC, so they don't give as much information as you 'd anticipate from, say, an openly traded firm. The certified investor need assumes that someone who is recognized can do the due diligence on their very own.

You just self-accredit based on your word., making it easier for even more people to qualify. I assume there will certainly be continued migration away from high expense of living cities to the heartland cities due to set you back and modern technology.

It's all about adhering to the money. Both are complimentary to sign up and check out.

Below is my real estate crowdfunding dashboard. Sam functioned in investing banking for 13 years.

He hangs around playing tennis and taking care of his family. Financial Samurai was begun in 2009 and is just one of the most trusted personal finance websites on the internet with over 1.5 million pageviews a month.

With the U.S. real estate market on the rise, financiers are sifting via every available residential property kind to uncover which will aid them revenue. Which sectors and properties are the best relocations for capitalists today?

Who offers the best Private Real Estate Investments For Accredited Investors opportunities?

Each of these types will feature special benefits and downsides that capitalists need to review. Let's consider each of the alternatives offered: Residential Property Commercial Real Estate Raw Land & New Construction Realty Financial Investment Depends On (REITs) Crowdfunding Systems Register to attend a FREE online real estate course and learn exactly how to get going investing in genuine estate.

Various other property buildings consist of duplexes, multifamily properties, and villa. Residential realty is ideal for lots of capitalists due to the fact that it can be less complicated to turn earnings continually. Naturally, there are several household genuine estate investing techniques to release and different levels of competitors across markets what might be right for one capitalist may not be best for the following.

What is the process for investing in Exclusive Real Estate Deals For Accredited Investors?

The most effective commercial properties to invest in include industrial, workplace, retail, friendliness, and multifamily tasks. For investors with a solid concentrate on improving their neighborhood communities, industrial property investing can sustain that focus (Accredited Investor Real Estate Crowdfunding). One factor industrial properties are taken into consideration one of the very best types of property financial investments is the possibility for greater capital

To discover even more concerning starting in , make certain to review this article. Raw land investing and new construction represent two kinds of property financial investments that can branch out a financier's profile. Raw land describes any type of vacant land readily available for acquisition and is most attractive in markets with high forecasted growth.

Buying brand-new building is additionally preferred in swiftly expanding markets. While numerous financiers might be not familiar with raw land and brand-new building investing, these investment kinds can represent attractive revenues for capitalists. Whether you have an interest in establishing a property from beginning to end or making money from a long-term buy and hold, raw land and brand-new construction offer a special opportunity to actual estate financiers.

Residential Real Estate For Accredited Investors

This will certainly guarantee you select a desirable area and prevent the investment from being obstructed by market variables. Actual estate investment company or REITs are firms that have various industrial real estate kinds, such as resorts, stores, offices, shopping centers, or dining establishments. You can invest in shares of these real estate firms on the stock market.

This uses financiers to obtain rewards while diversifying their profile at the very same time. Openly traded REITs likewise supply versatile liquidity in contrast to various other types of genuine estate financial investments.

While this uses the convenience of discovering properties to investors, this kind of actual estate investment likewise presents a high quantity of danger. Crowdfunding platforms are typically restricted to certified investors or those with a high web worth.

Who has the best support for Residential Real Estate For Accredited Investors investors?

The best kind of real estate financial investment will depend on your specific circumstances, goals, market location, and recommended investing approach - Real Estate for Accredited Investors.

Selecting the ideal residential property kind comes down to evaluating each choice's pros and disadvantages, though there are a few crucial factors financiers should bear in mind as they look for the best option. When picking the very best sort of financial investment residential property, the importance of place can not be understated. Financiers operating in "up-and-coming" markets may find success with vacant land or brand-new building and construction, while capitalists operating in even more "mature" markets may be interested in properties.

Examine your preferred degree of participation, danger tolerance, and success as you determine which residential or commercial property kind to buy. Investors wanting to tackle a more easy function might go with buy and hold commercial or household properties and employ a residential or commercial property supervisor. Those wishing to tackle a much more active function, on the other hand, may find developing uninhabited land or rehabbing household homes to be much more fulfilling.

Latest Posts

Tax Foreclosure Auctions

Tax Foreclosure Properties Auction

Delinquent Tax Homes For Sale